The Bankruptcy Helpline

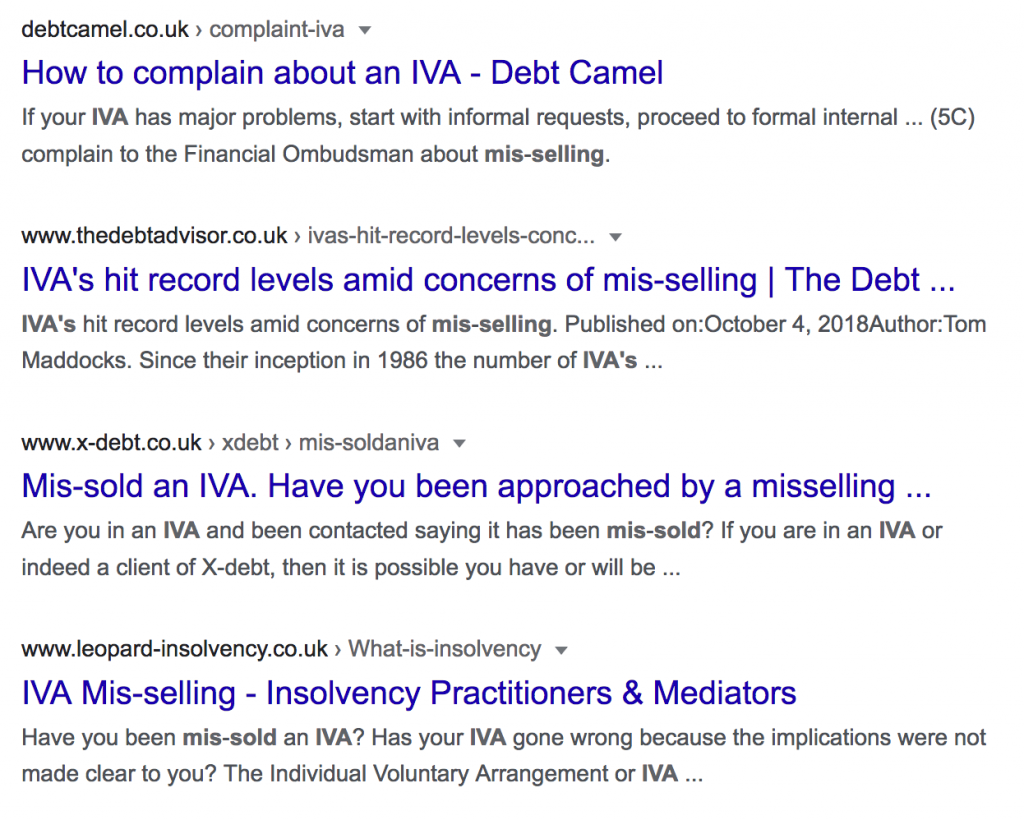

Below is an extract from the first page of google if you type in IVA mis-selling, some of the stories you will read are pretty horrific, over the last 18 years I have been in this industry I have seen the woes and misery of debtors being packaged up in these schemes,

In an IVA you can spread your debt and misery over 5 to 6 years, pay several thousands in fees to an organisation to administer your IVA, then gamble with a 1 in 4 chance of failure,

Or you can be debt free in 52 weeks with no possibility of failure and only a 1 in 5 chance of any monthly payments for three years.

Simply do the Maths,

An Individual Voluntary Agreement, known as an IVA, is a way to avoid bankruptcy. … At present, there is no official refund process for anyone who has been mis–sold an IVA but the Insolvency Service is now working with professional bodies to fix the problems raised in its review.

Channel 4 News spells what is happening in this Industry where IVA Companies are preying on people in debt and making a fortune in response

The news can be seen here

WHY are IVAs being sold, in preference to other debt solutions which may be more suitable, well

Google advertising and Facebook attract marketing companies who promote these solutions, You will be told “Government backed solution to reduce your debt up to 90%”. Well guess what the Government do not promote or encourage debtors to not pay their debts, imagine the fury from the banks if they did.

These companies, of which some are purely marketing companies look for eligible individuals to whom they can package up and sell on as leads to IVA factories for a referral fee often between £800 to £1100 pounds.

Over the years I have had calls from some of these companies telling me I could make three times my fee for doing no more than referring my clients to these companies, that is like selling my soul to the devil,I prefer to sleep at night

Remember the Claims management companies who sold accident claims leads to solicitors, this is much the same.

At present at least one in four IVAs are failing, five to six years is a long time penniless, the relief at the beginning when you are sold the IVA soon wears off when the practicality of being in one sinks in.

Many do not know, it is not until you make the final payment in an IVA that debt is satisfied, while in the IVA you still owe your debt in full, but now thousands of pounds in fees are added to the debt which you are responsible in paying.

I have seen debtors in an IVA inherit a property or a sum of money, during the term of the IVA lose their inheritance to the supervisor of their IVA, of course it is proper and correct that creditors are paid if this happens but you will also have to pay several thousands in fees even when the IVA finishes early.

Anyone who enters the IVA who owns property should study the equity release clause in years four or five where they will be expected to introduce funds into the IVA from the equity in the property.

Nowthat may or may not seem like much at the point of entry into the IVA but take the average increase in property say 4% per annum over the next 5 years by increasing a £200000 property to £243000 at the time of release, creditors will expect some of this equity before you are released from the scheme.

As with all debt solutions there are positives and negatives, go to an IVA company for debt advice you will be given an IVA,

I only provide a Full Bankruptcy Application service, I do this when the debtor has decided this is the route they want to go.

For debt advice you should only go to The Money Advice Service who only have your interests at heart to ensure you are given the full picture of all debt solutions so you are on the right track to debt recovery from day one.